TSP Calculator

Thrift Savings Plan Calculator

Embark on your journey towards financial security with our comprehensive Thrift Savings Plan calculator. Designed to empower federal employees and service members, the TSP Calculator provides an estimate of your retirement savings potential. Whether you’re just starting your career or nearing retirement, our TSP calculator factors in your contributions, government match, and projected growth to estimate your future TSP Balance. Make informed decisions to optimize your TSP investment strategy.

TSP Retirement Calculator

Knowledge is Confidence!

How to use the TSP Retirement Calculator

To project your TSP Balance at retirement, enter the following information:

TSP Account Balance

Current TSP account balance

Expected Rate of Return

Average annual rate of return you anticipate from now until retirement

Number of Years Until Retirement

Number of years until retirement

Annual Contribution + TSP Match

Total annual contribution from payroll deduction and government match. The maximum match is 5% of annual income.

What is a Reasonable Rate of Return?

The stock market is unpredictable so it becomes a challenge when choosing a return for a TSP investment projection. Use caution when looking at the 10-year average returns found on www.tsp.gov. The average historical return over the life of the TSP C fund is around ~10% whereas the last 10 years have shown over 12%.

What is the Best TSP Investment Strategy?

There is no correct answer to this question. The term “best” is relative to your specific financial situation, risk tolerance, and expectations for long-term average returns. Is your goal specific to maximizing TSP returns or creating a TSP investment strategy that is well-balanced with the goal of mitigating risk?

Best TSP Funds to Invest in 2024

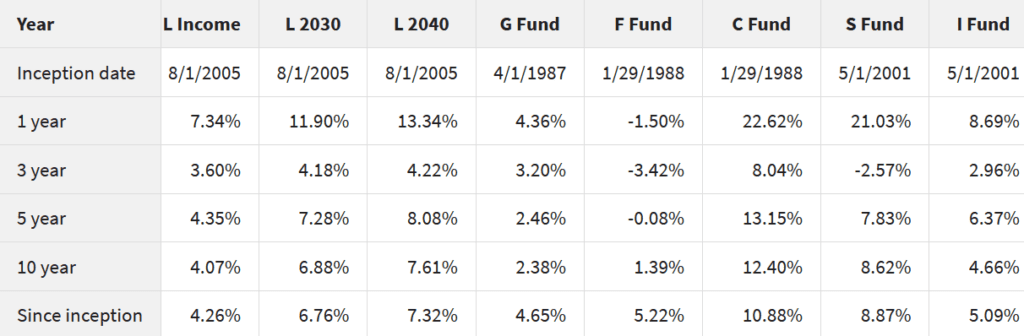

Below we have listed the most common core funds and their historical averages since inception and the 1, 3, 5, and 10-year returns. What are the best TSP funds for 2024? The answer depends on a number of factors such as your financial situation, risk tolerance, time horizon, goals, and objectives.

TSP Investing Strategies

It is important to determine your Thrift Savings Plan investment strategy. Are you able to clearly define your investment strategy objective? Most people are unable to define what investment strategy they are using. The TSP Retirement Calculator can only project based on expected return, not TSP investment advice.

Are the L Funds the Best TSP Investment Mix?

The L funds may be the right choice for someone who either doesn’t have the time or skill to review TSP investment options on their own. The ideal way to use L Funds is to pick the year closest to your retirement then put your entire TSP balance in it. Ultimately, the TSP L funds will end up in the L Income fund over time, which we know is heavily invested in the G fund. This gradual progression to a G fund-heavy investment objective may not be the right fit for you. Over time, the L Income fund may struggle to keep up with inflation.

Why Choose PlanWell Financial Planning?

Choosing PlanWell means choosing a client-centric approach that prioritizes understanding your unique financial objectives and risk tolerance. Using diversification to offset risk factors and market volatility, we craft investment strategies that promote stability and growth. Our team’s expertise, experience, and commitment to transparency and ethical practices set us apart. We will only act and advise in the best interests of our clients. When it comes to your financial future, trust in the guidance of a Certified Financial Planner – a commitment to excellence in investment management.

How We Work

Embark on your financial journey with PlanWell through a step-by-step process, from the initial consultation to ongoing portfolio management. Regular reviews and adjustments ensure your TSP investment strategy aligns with changing life circumstances and market conditions. Retirement investment strategies will not work unless they are reviewed and revised periodically. We aim to provide you with peace of mind, knowing your financial ship is always on course.

Have a Conversation with a TSP Expert

Unlock the secrets to maximizing your TSP investments with expert advice and strategies on the optimal TSP funds to invest in for 2024. From crafting a TSP investment mix to researching the top-performing Thrift Savings Plan funds, our TSP experts will walk you through every step. Whether you’re seeking TSP investing advice, exploring the optimal TSP investment strategy, or considering a Thrift Savings Plan rollover to a 401k or IRA, our seasoned TSP Financial Advisors provide actionable insights.

Navigate the complexities of TSP with confidence, backed by our TSP calculator retirement tools and comprehensive analysis of Thrift Savings Plan fees. Elevate your financial future with the best Thrift Savings Plan fund recommendations and stay ahead with the latest TSP investing strategies.

TSP Investment Management Services

We assist federal employees and service members in managing their retirement savings and are financial advisors for federal employees. We assist in professional education in navigating the various investment options within the TSP, including lifecycle funds and individual funds. TSP investing strategies will be personalized and based on each individual’s risk tolerance and investment goals.

Should You Transfer Out of TSP?

Have you retired or recently left Federal service? If so, you are probably wondering what you should do about the TSP. Should you leave your retirement funds with the Thrift Savings Plan (TSP) or transfer into a Individual Retirement Account (IRA)? Does a Thrift Savings Plan rollover to a 401k make sense? It is an important question to ask.

Thrift Savings Plan Workshops - TSP Webinars

Sign up today for our Thrift Savings Plan webinar here. TSP retirement webinars designed to cover the best TSP investment strategy and provide TSP advice. The TSP workshop covers: the best TSP funds to invest in 2024, TSP investing strategies, and the best TSP investment mix. Interested in having PlanWell host a TSP seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

TSP Financial Advisor for Federal Employees Near Me

Secure your financial future with the expertise of a TSP Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced TSP retirement planning specialists. Choose a TSP expert for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

TSP Financial Planner for Federal Employees Near Me

Plan your federal retirement with the expertise of a TSP Financial Planner near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.

Contact Us

When you are left wondering how to plan for retirement, PlanWell Financial Planning can guide you every step of the way. From establishing goals to implementing strategy and mitigating risk, we will make sure that your retirement plans are taken care of. To reach us, you can fill out our online form here, call, or email for any of your retirement planning needs. We’d love to help.

Get the latest federal retirement planning & benefit updates.

Osaic Form CRS

Check the background of your financial professional on FINRA’s BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Please Note: When you link to any of the websites displayed within this website, you are leaving this website and assume total responsibility and risk for your use of the website you are linking to. We make no representation as to the completeness or accuracy of any information provided on these websites.

PlanWell Financial Planning, LLC is not affiliated with, endorsed by, or authorized to speak on behalf of the U.S. Government, OPM, the Federal Employee Retirement System, or any other federal agency benefits programs or retirement plans, including the Thrift Savings Plan (Federal Benefits Plans).

Securities and advisory services offered through Osaic Wealth, Inc., member FINRA , SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Representatives may not be registered to provide securities and advisory services in all states

This site was crafted with care by Strong Roots Web Design.