FEHB & Medicare

Related Posts

Federal Employee Health Benefits & Medicare

FEHB is one of the most underrated benefits federal employees receive. The Federal Government pays ~72% – 75% of the premium while working and in retirement. Retired annuitants can continue to receive FEHB coverage as if they are working which means: the Federal Government still pays ~72% – 75% of the premium and you can change plans in open enrollment.

Open Season

Open season generally runs from Novemember 13th until December 11th. During open season you have the ability to change between plans:

- Self-only

- Self + one

- Self + family

- Change carriers or typle of plan

- High Deductible Health Plan (HDHP)

- Comprehensive

Additional Considerations

FEDVIP

Dental and Vision insurance may be kept in retirement as long as an employee retires under an immediate pension.

- No 5-year rule exists (like with FEHB and FEGLI)

- You may also enroll after you are retired

Flexible Spending Accounts

A Flexible Spending Account (FSA, also called a “flexible spending arrangement”) is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

- FSA contribution is deducted from your pay before taxes are taken out, so it’s considered pre-tax.

- Must spend the money or it becomes use-it-or-lose-it. The carryover limit is only $640 (2024).

- Not available to retirees

Health Savings Accounts (HSA)

A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in an HSA to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your out-of-pocket health care costs. HSA funds generally may not be used to pay premiums.

- No use-it-or-lose-it (can carryover unlimited)

- Must be on a HDHP

- You can invest the money in an HSA

- More info: Investing for Retirement with Your HSA: Health Savings Account as an Investment Vehicle

FEHB Premium Conversion

FEHB premiums reduce taxable income while working. At retirement, premiums are paid with after-tax money. FEHB is one of the few expenses that go up in retirement so make sure to plan for this. If you are married to another Fed and one of you retires before the other it may be worth switching FEHB to the working spouse to take advantage of the premium conversion for as long as possible.

Must Elect a Survivor Benefit to Maintain FEHB for Spouse

Very important! Beware of the survivor benefit rule if you are not married to a Fed. If you predecease your spouse and do NOT elect a survivor benefit, FEHB will kick your spouse and family off the plan. As a result, your spouse will either have to move to Medicare or find a private health plan.

For more info: Spouse Kicked Off FEHB in Retirement: Understanding Your FEHB Coverage as a Survivor Annuitant

Eligibility to Keep Coverage in Retirement – The 5-Year Rule

The employee must be enrolled in FEHB for the 5 years immediately preceding their retirement. The 5-year rule does not apply to married Feds if on a spouse’s coverage.

FEHB Strategies for Retired Military

Retired military has the option to pick up FEHB and then suspend right before retirement. This would allow you to keep FEHB in your back pocket and reenroll in the future without paying premiums. This is advantageous if TRICARE doesn’t cover a specific health care need or procedure down the road. The 5-Year rule does not apply here as TRICARE qualifies for the 5-year requirement.

For more info: Health Insurance Secret for Retired Military Feds: Suspend FEHB for Tricare

Medicare (not to be confused with Medicaid)

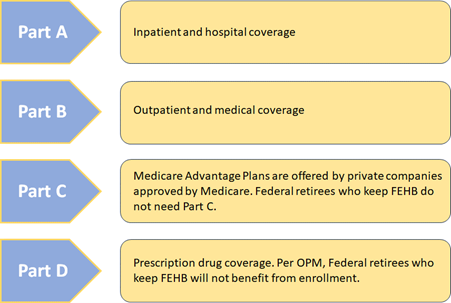

Medicare is a federal health insurance program for people who are age 65 or older. Most people pay into Medicare Part A while they are working through the FICA tax of 1.45%. There are four parts to Medicare.

Different Types of Medicare

When you first sign up for a Medicare plan and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare: Original Medicare (Part A and Part B) or a Medicare Advantage Plan (Part C). Some people need to get additional coverage, like Medicare drug coverage (Part D) or a Medicare Supplement Insurance (Medigap).

Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance)

- You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

Important! – Generally, you need to pay a portion of the cost for each service Original Medicare covers out-of-pocket. There is a deductible for Part A & B and then coinsurance is 20%. There is no limit to what you may pay in a year unless you have other coverage, such as a Medicare Supplement (Medigap), Medicaid or employee or union coverage, or you enroll in a Medicare Advantage plan.

Medicare Advantage (Part C)

If you have Part A and Part B, you can join a Medicare Advantage Plan, sometimes called “Part C” or an “MA plan.” This type of Medicare health plan is offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In addition, Medicare Advantage usually includes bonus benefits such as dental, vision, and hearing services.

An important distinction is that you are technically not on Original Medicare when using a Medicare Advantage plan.

More info: Medicare Advantage (Part C) vs Medicare Supplement (Medigap) – Which Is Best For You?

4 Options at Retirement

- Keep FEHB with Part B

- Keep FEHB with no Part B

- FEHB Advantage with Part B

- Suspend FEHB and enroll in Part B & Advantage Plan

More info: Should Federal Retirees Elect Medicare Part B in Retirement?

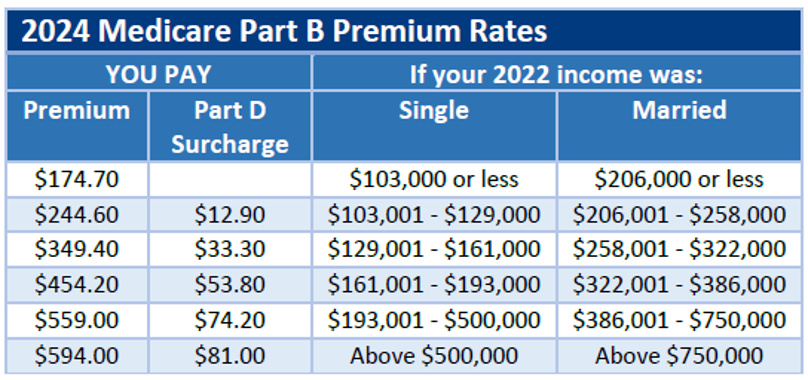

Medicare Part B Costs Are Income Dependent

Part B premiums are based on income two years prior. There is a way around this if you have just retired and want to bring your income forward to the present lower amount. More info: Just Retired and Stressed about Medicare Premiums? Avoid Paying Higher Medicare Part B and Surcharge (IRMAA).

Be careful of looming RMDs that could pop your total income into higher brackets for Part B. Make sure to consider income in the future on the decision to take Part B or not.

Federal Retirement Planning

At PlanWell, we are focused on federal retirement planning. If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). Choose a Financial Planner for federal employees. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds! Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.

Federal Retirement Workshops - FERS Webinars

Sign up today for our FERS webinar here. Federal retirement webinars designed to cover every benefit in only 3 hours. The FERS workshop covers: FERS pension, survivor benefit, Social Security, Special Retirement Supplement (SRS), Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), Federal Employee Health Benefits (FEHB), and Federal Long-Term Care Insurance Program (FLTCIP). Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

Financial Planner for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.